BTC Price Prediction: Analyzing Investment Potential Amid Market Consolidation

#BTC

- Technical indicators show BTC consolidating near key support levels with potential for upward momentum

- Mixed market sentiment balances positive institutional developments against macroeconomic concerns

- Long-term investment thesis remains strong despite short-term volatility and regulatory uncertainties

BTC Price Prediction

Technical Analysis: BTC Shows Signs of Consolidation Near Key Support

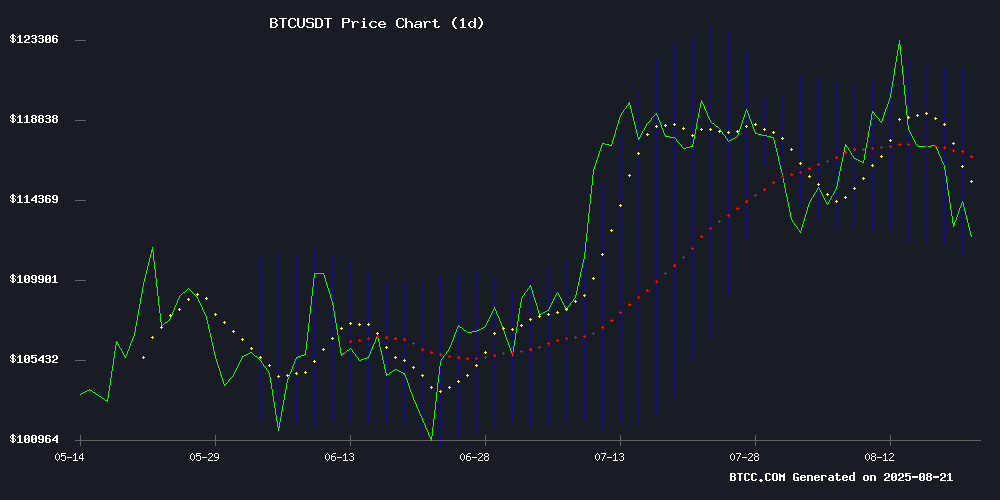

According to BTCC financial analyst Michael, Bitcoin is currently trading at $112,407.88, slightly below its 20-day moving average of $116,458.18. The MACD indicator remains negative at -21.9171, suggesting continued bearish momentum in the short term. However, the price is holding above the lower Bollinger Band at $111,084.36, indicating potential support at these levels. Michael notes that a sustained break above the 20-day MA could signal a shift in momentum toward bullish territory.

Market Sentiment: Mixed Signals Amid Consolidation Phase

BTCC financial analyst Michael observes that market sentiment remains cautious despite several positive developments. While Coinbase CEO's projection of bitcoin reaching $1 million by 2030 and corporate adoption continues, concerns around Fed hawkishness and economic pressures are creating headwinds. Michael emphasizes that the current consolidation above $113K, combined with institutional accumulation patterns, suggests underlying strength despite short-term volatility.

Factors Influencing BTC's Price

Bitcoin Consolidates Above $113K as Altcoin Accumulation Window Opens

Bitcoin's prolonged consolidation above $113,000 signals a potential inflection point for crypto markets. The asset has maintained this level for 48 hours despite recent volatility, with institutional and retail investors interpreting the pause as an accumulation opportunity.

Historical patterns suggest such consolidation after rapid appreciation often precedes significant upward moves. Current technical indicators support this thesis—Bollinger Bands show price hovering near the lower boundary while RSI readings at 42 avoid oversold territory. Liquidity clusters between $112,500-$113,000 demonstrate strong defensive positioning.

The stability in BTC frequently acts as a springboard for altcoin rallies. Projects combining clear utility with growing ecosystem support appear particularly well-positioned should capital rotation occur. Market participants are scrutinizing fundamentals more rigorously than during previous cycles, favoring protocols with measurable adoption over speculative narratives.

Victim Loses $91M in Bitcoin in Social Engineering Scam: ZachXBT

Blockchain investigator ZachXBT revealed a sophisticated social engineering attack resulting in a $91.4 million Bitcoin theft. The victim surrendered credentials to a fraudster posing as a hardware wallet support agent on August 19.

The stolen 783 BTC entered a laundering cycle through Wasabi Wallet, a privacy-focused tool. This incident echoes a troubling pattern of crypto scams, contributing to the $3.1 billion lost to hacks in 2025's first half.

The breach coincides with the anniversary of the $243 million Genesis creditor theft, a case that prompted multiple arrests last May. Security experts warn such attacks are becoming increasingly refined.

Bitcoin Tumbles as Economic Concerns Amplify Market Fears

Bitcoin recently breached its $112,500 support level, sliding to a new low of $112,201. While altcoins have yet to see sharp sell-offs, bearish sentiment is expected to dominate for weeks. The Federal Reserve's upcoming meeting looms large, with market tariffs exacerbating volatility. Fitch Ratings' latest report hints at broader crypto market vulnerabilities.

Consumer spending is projected to weaken significantly in early 2025, diverging from late 2024 trends. Trade policy uncertainty, equity market fluctuations, and eroding consumer confidence are denting household expenditures. A tightening labor market and shrinking job supply further constrain income growth.

"Tariff costs are now feeding into goods prices, creating inflationary pressure," notes Economic Research Director Olu Sonola. This dynamic raises stagflation risks in coming quarters. As spending contracts and confidence wanes, risk appetite across markets—including cryptocurrencies—faces mounting pressure.

Rare Bitcoin Bull Signal Nears Activation; Analyst Says It Has Never Failed

A long-term Bitcoin indicator tracked by analyst bitcoindata21 is nearing activation, historically signaling the start of major rallies. The signal triggers when Bitcoin's price touches a specific upward trendline, which has preceded every significant bull run since 2017.

Despite current market fears of a bear phase—with Bitcoin dipping 4.71% weekly to $113,300—technical analysis suggests an imminent rebound. Historical data shows each touch of this trendline has led to decisive upward momentum, with the analyst asserting the signal "has never failed so far."

Market observers speculate a breakout could propel Bitcoin toward $145,000, echoing past cycles where similar patterns ignited parabolic advances. The crypto community watches closely as Bitcoin teeters on the cusp of what may become its next macro rally.

BTC Mining in 2025: HashJ Insights Highlight Growth and Optimization

Bitcoin mining remains the backbone of the cryptocurrency ecosystem, driving network security and decentralization. By 2025, the industry is poised for significant evolution, with platforms like HashJ offering advanced tools for profitability analysis and performance monitoring. Miners continue to rely on ASIC devices to solve complex mathematical problems, earning block rewards and transaction fees.

The Bitcoin network's resilience hinges on mining activity, ensuring fraud resistance and operational integrity. HashJ's platform provides miners with real-time data and trend analysis, positioning itself as a critical resource for optimizing returns. With block rewards set at 3.125 BTC post-April 2024, efficiency and strategic planning are paramount.

Updated projections for August 2025 suggest heightened competition and technological advancements in mining hardware. HashJ's free $118 credit incentive underscores the platform's commitment to attracting new participants. The interplay of energy costs, hardware efficiency, and regulatory developments will shape the mining landscape in the coming years.

Bitcoin’s Uncertain Future: Bearish Trends and Macro Pressures

Bitcoin faces mounting resistance at $112,500, with repeated failures to breach this critical level fueling concerns of a prolonged bearish phase. Analysts point to macroeconomic headwinds—particularly delayed rate cut expectations—as the primary catalyst for the downturn. Altcoins, which briefly rallied earlier in the week, now mirror BTC’s weakness following cautious remarks from Federal Reserve officials.

Chart patterns suggest a potential double top formation for Bitcoin, with Washigorira signaling a risk of deeper declines toward $99,000 if support at $98,000 fractures. Liquidity pools below this threshold remain a focal point for traders anticipating volatility.

Market participants await Fed Chair Jerome Powell’s upcoming commentary, which could dictate near-term momentum. The current standoff between bullish conviction and macroeconomic skepticism leaves cryptocurrencies at an inflection point—offering neither clear entry signals nor conclusive exit strategies.

Fed's Hawkish Stance Weighs on Bitcoin as Rate Cut Expectations Dim

Cleveland Fed President Beth Hammack delivered a firm rejection of imminent rate cuts during the Jackson Hole Economic Symposium, sending ripples through cryptocurrency markets. "Inflation remains too high and continues its upward trajectory," Hammack stated, emphasizing no September easing would be warranted. Bitcoin slid below $113,000 as traders recalibrated expectations—CME FedWatch now shows just 71% odds of a cut, down from near-certainty last week.

The hawkish commentary reinforces Chair Powell's stance despite political pressure for lower rates. Former Fed officials like Jim Bullard have recently advocated for dramatic 100bps cuts, creating policy tension. Cryptocurrencies, which surged to record highs amid dovish expectations, now face headwinds from renewed monetary restraint.

Anthony Pompliano Reaffirms Bitcoin's Dominance Amid Market Volatility

Anthony Pompliano, founder of Professional Capital Management, dismissed the outdated 'blockchain, not Bitcoin' narrative during a CNBC interview, asserting Bitcoin's unchallenged supremacy in the crypto ecosystem. The argument—popularized during the 2016-2017 cycle—claimed blockchain technology held greater value due to its utility in tokenization and supply chains. Pompliano countered that Bitcoin has since validated its dominance through market performance and investor preference.

Market volatility stems from fragmented capital allocation across strategies, Pompliano noted. While some investors chase yield or infrastructure bets, others prioritize holding the underlying asset—Bitcoin itself. This divergence underscores BTC's dual role as both a speculative vehicle and a store of value.

The discussion touched on Bitcoin ETFs, though the segment was truncated. Their growing adoption reflects institutional recognition of Bitcoin's primacy, further cementing its position as the reserve asset of crypto markets.

Coinbase CEO Projects Bitcoin Could Reach $1M by 2030 Amid Regulatory Progress

Brian Armstrong, CEO of Coinbase, has made a bold prediction that Bitcoin could soar to $1 million by the end of the decade. His remarks, shared during an interview on the Cheeky Pint podcast, underscore growing optimism around the cryptocurrency's long-term trajectory.

Regulatory developments in the United States are fueling confidence. Armstrong highlighted pending stablecoin legislation and a Senate market structure bill as signs of progress. "Fingers crossed, something could happen by the end of this year," he said.

The U.S. government's accumulation of Bitcoin as a strategic reserve marks a significant shift. Armstrong described this as a "huge milestone," noting that fears of a government ban on Bitcoin have largely dissipated.

Institutional adoption remains in its early stages, with investors currently allocating just 1% of their portfolios to Bitcoin. Armstrong's projection suggests this figure could rise dramatically as regulatory clarity improves and institutional participation grows.

Corporate Bitcoin Treasuries Could Raise Credit Risks, Morningstar DBRS Says

Corporate adoption of Bitcoin as treasury reserves is gaining traction, but Morningstar DBRS warns of heightened credit risks. Roughly 3.68 million BTC, valued at $428 billion as of mid-August, are held across companies, ETFs, governments, and DeFi protocols. This represents 18% of Bitcoin's circulating supply.

Public companies hold 27% of these assets, with MicroStrategy dominating at 64% of corporate holdings. The report flags regulatory uncertainty, liquidity challenges during volatility, and exchange counterparty risks as key vulnerabilities. Bitcoin's price volatility and custody security concerns add further complexity to corporate crypto strategies.

Winklevoss Twins Donate $21 Million in Bitcoin to Support Trump’s Pro-Crypto PAC

Cameron and Tyler Winklevoss, founders of the Gemini exchange, have committed 188.45 BTC—worth $21 million—to the Digital Freedom Fund PAC. The donation aims to bolster Donald Trump’s pro-crypto agenda, which seeks to position the U.S. as the global leader in digital asset innovation.

The newly formed PAC, filed on July 11, will channel funds toward supporting crypto-friendly legislators in the 2026 midterm elections. Tyler Winklevoss highlighted the critical role of a Republican-majority Congress in advancing regulatory clarity for the industry.

Trump’s administration has prioritized mainstream adoption of cryptocurrencies, with the Winklevoss twins framing their contribution as a safeguard for policy continuity. The PAC’s broader mission includes securing legislative wins for digital assets beyond the current election cycle.

Is BTC a good investment?

Based on current technical indicators and market developments, Bitcoin presents a compelling long-term investment opportunity despite short-term volatility. The current price of $112,407.88 represents a potential entry point for investors with a horizon beyond immediate market fluctuations.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $112,407.88 | Near support levels |

| 20-day MA | $116,458.18 | Slight resistance |

| Bollinger Lower | $111,084.36 | Strong support |

| MACD | -21.9171 | Bearish momentum fading |

Michael suggests that institutional adoption, regulatory progress, and long-term projections support BTC's investment case, though investors should be prepared for continued volatility in the near term.